Bundle Pricing

The willingness of consumers to pay can, at times, be quite volatile. With bundle pricing, the seller lowers the variance on this willingness to pay and increases its profit by selling bundles of products instead of selling all products separately. Moreover, the seller makes bundles in order to fulfill a specific need of its customers: the bundle fits a unit of need and therefore it becomes more pertinent for the consumer to purchase it.

Therefore we can define two types of bundling:

- The “unit of need” bundling which aims to fulfill a specific and complete customer need.

- The “naked” bundling which aims to maximize profits with non-perfectly complementary products.

Fictitious example of profit maximization with naked bundling

Let’s explain the principle of bundle pricing with a simplified example: a firm selling two types of chocolate (White and Black). Two consumers want to buy some chocolate, the first one (A) is willing to pay $15 for White and $9 for Black, and the second is willing to pay $8 for White and $13 for Black. Let assume that the production costs for both products are $2 each.

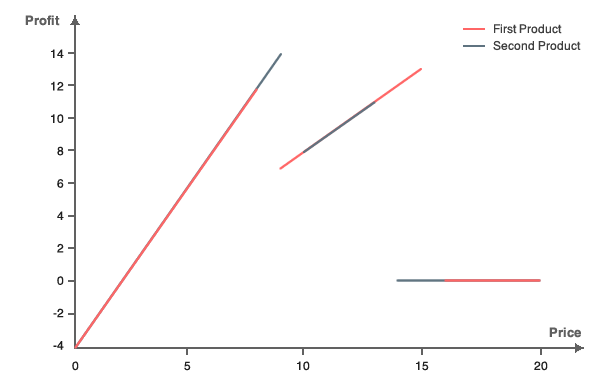

The amount of profit generated depending on the two prices chosen can be observed in the graph below (blue is White and green is Black). The prices that maximize profit are $15 for White and $9 for Black. In this case, the profit is $27, but the firm doesn’t sell any White chocolate to the second consumer while he pays $4 less for his Black chocolate when examined in relation to his willingness to pay.

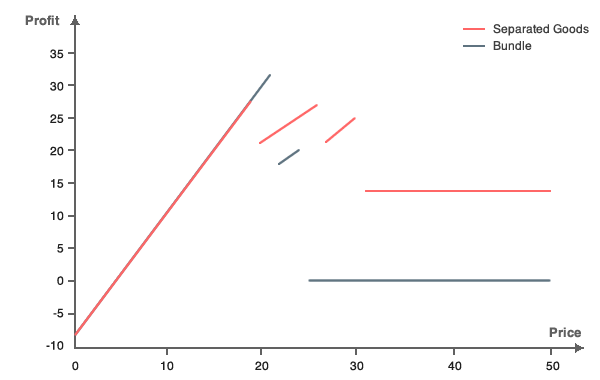

The chocolate retailer could on the other hand sell a bundle of white and black chocolate. For every different bundle price, we can display the profit as displayed on the graph below (the green line). The blue line represents the maximum profit that can be earned by selling goods separately given that the total price of the separate goods bought together is the same as that of the bundle.

With bundle pricing, the new maximum profit that can be earned in this case is $34 with the price of the bundle set at $21. In this case, selling the bundle increases profit by about 25%.The higher the variations in willingness to pay, the higher the profit increase.

Principle behind “naked” bundling

Bundle pricing relies on economic principles such as the variance in willingness to pay, economies of scale, cost of bundling or simplification. The variance in willingness to pay allows the bundle to create substitution between the products contained within the bundle in order to maximize profit. Positive economies of scale are necessary because bundling increases demand. The cost of bundling also needs to be considered since it could lower the profit increment if not taken into account. Simplification for customers when purchasing a bundle (they do not need to search for different products separately for example) also provides a positive psychological effect which can potentially increase demand.

If the consumers’ willingness to pay has no variance, then the bundle will bring exactly the same profit as using separate prices when selling products individually On the contrary, if the consumers’ willingness to pay does have some variance, then selling by bundle will maximize profit because it “transfers” some willingness to pay from one product to another, and consequently the “median” price of the bundle allows more consumers to buy it.

In our example, selling by bundle transfers some of the willingness to pay for white chocolate to black chocolate for the first consumer, and transfers some of the willingness to pay for black chocolate to white chocolate for the other consumer.

Since we established that with bundle pricing more consumers are able to buy, the seller needs to at least have constant economies of scale. Otherwise, if the production costs increase with the increasing amount of sales, bundle pricing could bring less profit than using separate prices for individual items. On the contrary, if the economies of scale are positive (the marginal cost is non-increasing), then the potential for the firm to increase its profit is even higher when selling by bundle.

Similarly, bundle pricing is more efficient when the cost of bundling is low. For example, putting together two types of chocolate is likely to have a packaging cost and could therefore lower the profit when bundling.

In our case with chocolate, if the cost of creating bundles is $7 or more, then the bundle becomes less profitable than selling goods separately.

Moreover, when consumers are willing to buy (at different prices) the products in the bundle, purchasing the bundle could seem as a simplification of the buying process and therefore improve consumers’ utility.

Real examples of bundle pricing

Bundles are common in many different business sectors and they seem natural and familiar. For example most of restaurant menus are in fact a bundle of appetizer, main course and dessert. The famous MacDonald’s “Best of” Menu is the canonic example of bundle pricing. For about $8 you have a burger, some French fries and a drink. This strategy maximizes demand because the willingness to pay for a burger, some fries and a cold drink complement each other and the menu fulfils a unit of need. Microsoft too uses bundling for its Xbox One. For example, on Amazon, the price of the Xbox One alone is $345, but when bundled with Halo the price rises by only two dollars to become $347. Therefore, according to classical economics, the demand for a bundle is higher if the cost of bundling is low, which in turn maximizes profit.

Legal limits of bundling

Most types of bundling are legal as far as complementary goods are concerned, as long as they represent a unit of need and aren’t sold by a company that is highly dominant on the market.

If the products in the bundle do not really represent a unit of need, in this case bundling could be forbidden by law. There are laws against anti-competitive tying in most countries. The idea behind forbidding such practices is to refrain companies from increasing their profits by using their dominant position on the market to force consumers to buy something they do not really want or need. This type of behavior can be considered as anti-competitive.

Similarly, there are also laws that exist to restrict bundling “by contract” between two firms with a dominant position on the market. For example, the first Apple iPhone was bundled with a subscription of the AT&T mobile network provider. This type of bundling illegal because Apple and AT&T both used their dominant market position in order to sell a premium product which was not sold by any of their competitors. By using the described bundling techniques the two companies in question created a monopoly-like market and were consequently reprimanded by the authorities.

References

- Hanson W. & Martin K., “Optimal bundle pricing”, Management science, 1990

- Salinger M. A., “A graphical analysis of bundling”, Journal of business, 1995

- Stremersch S. & Tellis G. J., “Strategic bundling of products and prices: a new synthesis for marketing”, Journal of Marketing, 2002