Cost-Plus Pricing

Cost-plus pricing consists of setting the price based on the production cost and the desired level of mark-up. This method allows a company to secure margin and is easy to compute on a large amount of products. According to Chris Guilding et al, this method is widely used by retail companies today on at least some of their products, and they consider this type of pricing to be important in their global pricing strategy.

Cost-plus pricing is a main part of pricing history even if it seems to be used less and less. By comparing several studies in 1992, Ward Hanson demonstrated that the rate at which companies used this type of pricing in the United-Kingdom stood at 80% prior to World War II, 70% in 1970 and only 59% in the late 1980s. This decreasing rate could be explained by the main disadvantages of cost-plus pricing. In particular it ignores competitors’ prices and production costs have a tendency to overrun.

General principle

Cost-plus pricing secures margins by fixing mark-up. In order to reach a given mark-up objective, a firm sets the price by a simple multiplication of the estimated production cost (variable cost and fixed cost) by the desired mark-up for an anticipated level of sales.

With $$F$$ being the fixed cost, $$V$$ the variable cost by unit, $$M$$ the desired mark-up and $$S$$ the estimated number of sales, the price is set as follows:

A firm has fixed costs of $900 and a variable cost of $1 per unit. They estimate that they will sell 100 units. Their total cost is 900+100 = $1000 meaning a price of $10 per unit. They want to fix their mark-up at 30%. Therefore, the price will equal to 1.3 x 10 = $13 and the profit will be 3 x 100 = $300.

In the retail industry, it can be rather difficult to estimate future sales (and therefore also the future variable costs and future revenues). As a result, there is a “weaker” version of the cost-plus pricing which allows prices to be calculated with less information than required in the standard formula. By taking the variable cost alone, it is possible to set a price with the following formula:

The main issue with this approach is that the product mark-up will be lowered by the fixed costs ex-post. In the retail industry for instance, the fixed costs frequently tend to be rather negligible. In this case, the amount of sales can change the costs; in the case of retailers having quotas for reaching price breaks for example.

A firm has fixed costs of $200 and variable costs of $10 per unit. The price of its product is therefore $13 with markup of 30%. If it sells 100 units, the profit is 3x100-200 = $100.

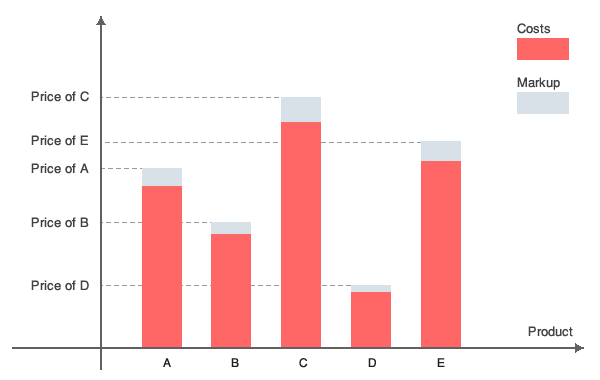

Cost-plus pricing implies using the same desired mark-up on a large amount of products. Fundamentally, all types of pricing could be defined as being cost-plus on some level, but if the mark-up is different for all products then all the advantages of using this method are lost. Therefore, we assume that cost-plus pricing is about a few $$M$$ for a large amount of products.

Why use Cost-plus pricing?

First of all, this type of pricing is easy to compute, in particular the “weaker” version of the calculation method. For each product, the price is set by a simple multiplication by $$(1+M)$$ of the cost. For example, a retail firm with a large amount of products could choose all its prices by simply adding the desired mark-up to the purchase price. In the case of price breaks, the retailer must consider the purchase price they are likely to pay.

In addition, with this method, profits are guaranteed by the contract in place and there is less risk of loss: this pricing method is one of the most risk-averse. Each unit sold increases the margins because costs are paid back and the mark-up is converted into margin.

Lastly, this type of pricing is relatively transparent to clients as it is rather easy for companies to explain how the pricing is set. For example, a firm can explain that by having its costs at $$C$$ and its mark-up at $$M$$, the set price is entirely justified. The transparency of the pricing method allows it to be understood by all clients.

What are the main issues with cost-plus pricing?

Cost-plus pricing doesn’t take into account the prices of other competing firms on the market. The price is determined based on sourcing factors and it is only afterwards that it is compared with others companies’ prices. If the price is too low, this means that margins could have been higher and therefore that profits could have been better. On the other hand, if the price is too high, then the number of sales could be lessened by the competition. Since the mark-up is defined by the anticipated purchase price and fixed costs, then the margin is smaller than expected and can even be negative in some cases.

A firm has fixed cost of $900 and variable costs of $1 per unit. They anticipate to sell 100 units. The total cost is 900+100 = $1000, or in other words the price is fixed at $10 per unit. They want to achieve a markup of 30%. Consequently, the price will be 1.3 x 10 = $13. Their competitor fixed their price at $11. Therefore, the demand of the company in question is only of 50. Their cost for this amount of production is $950 and their revenue is 50x13 = $650. The profit is -$300 instead of the +$300 expected.

The Production costs have a tendency to overrun in the case of bespoke products. There isn’t any incentive for engineers or product developers to control the production costs with the required constraints. They manufacture whatever they see fit (by adding new expensive features or developing new designs for example) without taking into account the reality of their market.

Contract costs also have a tendency to overrun. If a supplier has a cost-plus contract with one of its customers his mark-up is fixed, and therefore the more costs he has the more profit he makes. For example, according to Center for Strategic & International Studies (CSIS), cost-plus contracts are the norm in the defense industry and therefore governments tend to overpay for most of its military equipment.

At the same time, the supplier can make two products A and B to be of the same quality. Product A costs $100 and B costs $120. In the contract, the markup is specified to be fixed at 10%. Therefore, since the margin will either be $10 (Product A) or $12 (Product B), the firm will chose to sell product B because it maximizes its profit.

References

- Center for Strategic & International Studies (CSIS), “Defense industrial initiatives. Current issues : Cost-plus Contracts”

- Guilding C., Drury C. & Tayles M., “An empirical investigation of the importance of cost-plus pricing”

- Hanson W., “The dynamics of Cost-plus Pricing”, Managerial and decision economics, vol. 13, 149-161, 1992