Penetration Pricing

Penetration pricing is a very aggressive type of pricing. When using this method, a firm first sets its prices at a very low level (sometimes even with negative margin) in order to increase customer demand. After this, the company raises the price again, hoping to capture the same level of customer demand as with its previous very low level of pricing.

Penetration pricing is often seen as a pricing method that is the opposite of price skimming. Although very different in nature, these two specific types of pricing seem to be the most efficient for new products according to Spann, Fischer and Tellis. With penetration pricing, a company hopes to make its customers loyal by selling at a very low price in the beginning and increasing the price in some time. In addition, with price skimming, a company is looking to maximize its long-term profit by acquiring as much consumer surplus as possible by setting a relatively high price in the beginning and lowering it over time.

The effectiveness of using a penetration pricing strategy is strongly linked to the price elasticity of demand. If the demand is very elastic, penetration pricing results in a high level of demand when prices are low, but this high level of demand drops significantly when the company decides to raise its prices. On the other hand, lowering one’s prices in an elastic market can potentially be efficient if the increase in demand compensate for the loss in the price.

Economic principle

Penetration pricing relies on one main assumption: if the consumer becomes loyal to a firm, the demand consequently becomes less elastic over time. As a result, a firm accepts a loss of surplus during the first stages of implementing its penetration pricing strategy because it must sell at a lower price in order to capture additional market share. Consumers gradually become loyal to the company due to this lower price, and since the demand becomes almost inelastic in the long term, the firm can thus increase its profits by raising the price afterwards (for a more detailed explanation, see our article on price elasticity of demand). This demonstrates that in the long run penetration pricing transforms elastic demand into inelastic due to acquired consumers’ loyalty.

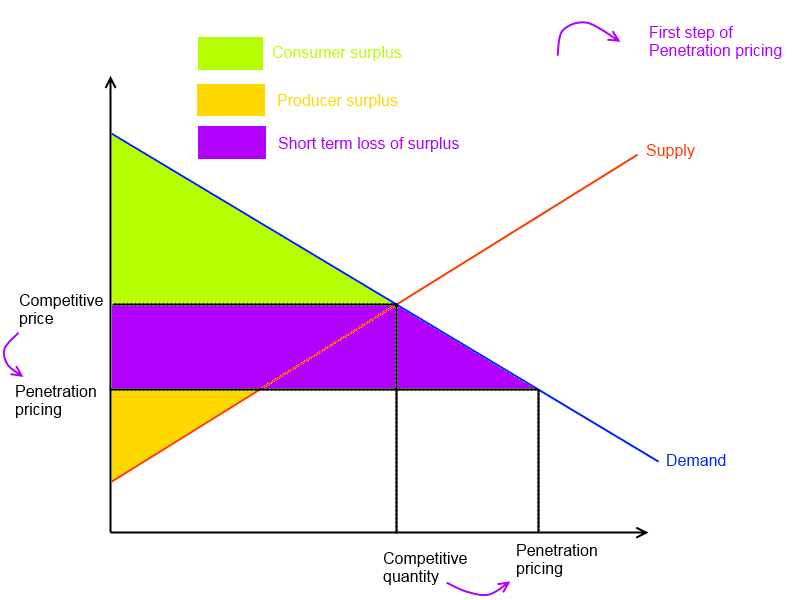

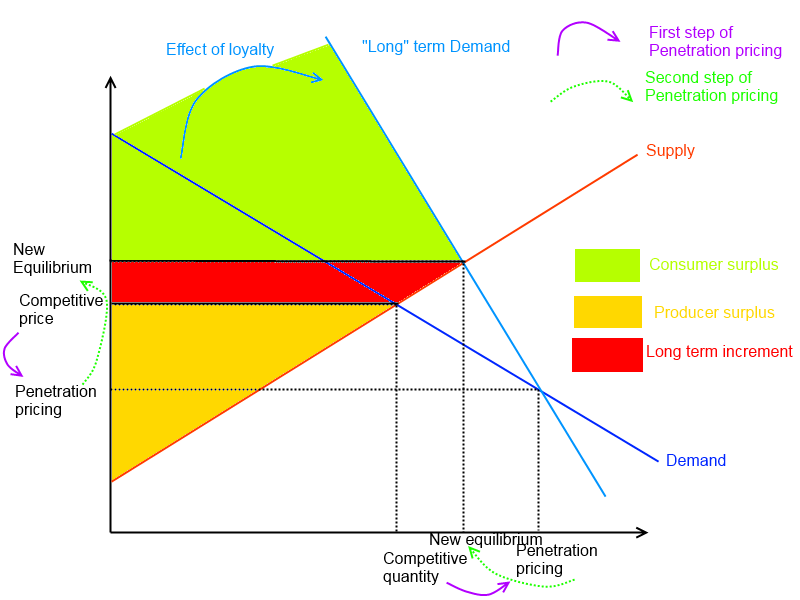

This can be illustrated graphically in two separate stages.

First, the initial decrease in price leads to a short-term loss of economic surplus but an increase in demand.

Second, when the price is raised in the long-run (following the initial decrease), there is an evident increase in the long-term economic surplus resulting from a gain in customer loyalty.

Scope and examples

Penetration pricing and price skimming are two opposing long-term pricing strategies. The first consists of setting low prices in the beginning and increasing them over time in order to maximize profit in the long term, while the second consists of setting high prices in the beginning and reducing them over time.

According to Spann, Fisher and Tellis, penetration pricing is more efficient than price skimming when it comes to a firm that is a new entrant in a competitive market and which operates in a low-priced industry segment. Moreover, the product or service sold by the firm in question must be able to generate customer loyalty. Here are some examples of these types of markets:

Subscription services. Subscription services such as having a telephone line or satellite television are good examples. The price of such services is often lowered for the first year and is then raised by the operator from the second year onwards. In this case, the first year of service is offered to the consumer at a penetration pricing rate. The price of the subscription is raised at the end of the first year, and if the consumer decides to retain his subscription, the demand for this service becomes inelastic. As a result, the service provider maximizes its profits in the long term.

Companies with a bait and hook business model. In this case, a firm benefits from selling mutually dependent products in order to maximize its profits. For example, razor manufacturers tend to sell razors at a low price, but the blades refills at a high price. Another two similar “bait and hook” examples are printers (and cartridge refills) as well as game consoles (and the video games that go with them afterwards).

High-low prices. While a firm may set low prices for certain items in its catalogue in order to attract customers, the rest of the goods usually remain highly-priced. In this case, the company relies on consumers to first come to their stores (or websites, etc.…) for the cheaper type of goods, but to end up purchasing both low and high-priced goods in the end. To illustrate, Walmart uses high-low pricing tactics in order to attract customers into its shops. It can even be said that is uses loss leader pricing tactics because while it sells some of its products at a loss, other higher-priced products bring considerable profits.

References

- Dean J., “Pricing policies for new products”, Harvard business review, 1976

- Spann M., Fischer M. & Tellis G. J., “Skimming or penetration? Strategic dynamic pricing for new products”, 2014